The National Association of Realtors released a relatively gloomy report today that showed that sales contracts on previously owned U.S. homes fell 4.7% in May from the prior month. The Association, which has a reason to be optimistic, forecast that housing sales will rise later in the year.

"Existing-home sales are expected to grow from an annual pace of 5.01 million in the second quarter to 5.75 million in the fourth quarter. For all of 2008, existing-home sales should total 5.31 million, and then increase 5.0 percent next year to 5.58 million."

But an interesting post in Accrued Interest does the math on the housing market and finds huge inventory of unsold houses.

"Normal household formation won't soak up the supply for a while. A recent report from Lehman Brothers indicated that there will be 4 million units which need to be absorbed by the end of 2009, both foreclosures and new home construction. About 1 million can be taken down by normal household formation. That leaves 3 million homes to sell, a pretty big nut to crack.

Demand could come from either current renters becoming home owners or investors. In both cases, prices need to drop a large degree to stimulate demand for 3 million marginal homes."

Sales may be on the rise but that's only one piece of the picture. Prices are going to have to continue dropping for some time to soak up all of the new, existing, and foreclosed houses that have flooded the market.

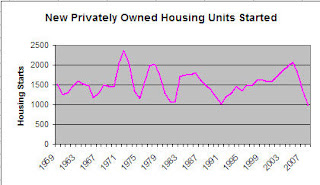

The US Census Bureau released their housing data for May and it showed continued deceleration in residential home construction:

The US Census Bureau released their housing data for May and it showed continued deceleration in residential home construction: