The week started with the Fed stating that they plan to keep the Fed funds rate low for the foreseeable future. The news had an interesting impact on cd and savings rates. Short term rates stayed flat while longer-term rates dropped. At the same time, average mortgage rates rose as the Fed signaled an end to its measures to purchase mortgage backed securities and force down rates. In the Fed's words:

To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter of 2010.

Last week, I mentioned that U.S. Treasury Inflation-Protected Securities were indicating that inflation was going to be relatively tame over the next 10 years. Now comes a new article in Bloomberg which says that TIPS are indicating a pick-up in inflation over the next year. According to Bloomberg:

The gap between yields on Treasuries and so-called TIPS due in 10 years, a measure of the outlook for consumer prices, closed above 2.25 percentage points four days last week, the longest stretch since August 2008. That’s the low end of the range in the five years before Lehman Brothers Holdings Inc. collapsed, and shows traders expect inflation, not deflation in coming months, said Jay Moskowitz, head of TIPS trading at CRT Capital Group LLC in Stamford, Connecticut.

Of course inflation is currently very tame. Consumer prices rose .4% in Novembmer, with core inflation flat. There is no sign of any goods or services inflation at the moment. The only inflation we've seen is in th stock and commodity markets.

I personally think we'll see some uptick in inflation but not the raging wildfire many are predicting. Large deficits will collide with sluggish demand and high unemployment to keep inflation mostly in check. I expect the Fed Funds rate will be in the 3-4% range in the next 24 months. That means we'll see deposit accounts move off their rock-bottom lows. That's still 2 years away though.

CD and Savings Rates

Savings rates stayed steady at 1.57% APY last week. 1-year CD rates also stayed flat at 1.96% APY. This marks the first time in months that both savings and 1-year CD rates have not dropped. What's even more interesting, is that they held while 3-year and 5-year rates dropped considerably. Three-year rates dropped by 8 basis points from 2.72% APY to 2.64% APY while 5-year CDs dropped from 3.26% APY to 3.21% APY.

Why the difference? I think short term savings and cd accounts are at or near the bottom. Longer-term rates have had a bit more of an inflation premium. But the Fed's announcement last week and the tame inflation data have pushed longer-term deposit rates down. Both depositors and banks seem to be indicating they are not afraid of longer-term inflation.

Looking at the yield ratio we have developed for deposit accounts, the spread the spread between savings rates and 36-month CDs came down again this week due to the drop in 3-year CD rates. This drop in longer-term CD rates reverses the slightly upward movement that we saw since the summer. It's possible we'll see 5-year CD rates below 3% APY in the next couple of months if the current trend continues.

It's still hard to recommend putting money into anything longer-term than a 12-month CD, especially with rising equity markets and signs that the economy may be coming back to life. Many depositors may be willing to lock money away for 5-years at close to 3%. To me that's just not enough of a return for that period of time. For those worried about interest rate risk, cd laddering may be a good way to smooth out the return you receive from your CD portfolio.

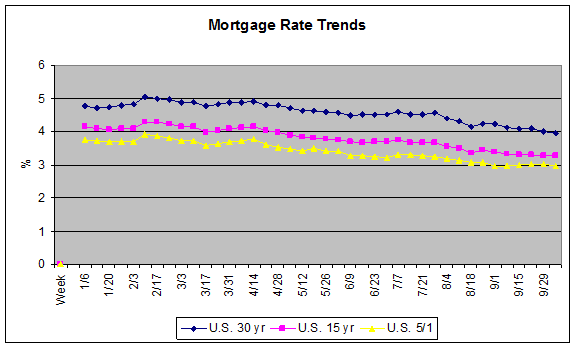

Mortgage Rates

According to Freddie Mac's weekly survey, 30 year mortgage rates rose by 13 basis points from 4.81% to 4.94%. Data from th BedstCashCow rate tables show that average mortgage rates actually dropped from 4.97% to 4.95%. Either way, with the Fed getting ready to end its purchase of mortgage-backed securities, we'll probably see rates above 5% shortly. From all indications, mortgage rates are going up, which is bad for homebuyers and the general housing market.

You can compare the best mortgage rates in our new mortgage section.