As Bank of America's stock has plunged, its dividend has soared. It paid a dividend of 64 cents a share in April which amounts to a 11.61% dividend yield. Should you invest? It depends on your risk appetite.

Ken Lewis, the Bank of America CEO recently went on record as saying that the bank will not cut its dividend or raise additional capital. In an interview with LA Times reporters, Lewis said:

"Given our view of things, we do not expect to cut the dividend nor do we expect to have to raise capital."

He also went on to say that the Countrywide purchase was already profitable for the bank.

"On a weeklong California trip that included a Town Hall Los Angeles luncheon address Wednesday, Lewis acknowledged that loan losses at Countrywide were at the high end of estimates that Bank of America projected in January.

But he said Bank of America paid so little for the lender that once the books on the deal were closed, the Countrywide operation would immediately show a profit -- with the potential for huge growth in income when the mortgage industry recovers."

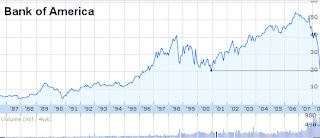

Wall Street doesn't seem to believe this, pushing Bank of America stock down to its lowest level in almost eight year. Just yesterday, Morgan Stanley analyst Betsy Graseck downgraded Bank of America and said that the bank would have to raise an additional $12 billion in capital and cut its dividend.

So who is an investor to believe? I personally think Bank of America is a pretty savvy operation and that they knew what they were buying with Countrywide. They probably were able to model a range of losses that they would experience with their porftolio and included that in their business projections. Surely, their data is more accurate than the models created by Wall Street bankers who have no first-hand experience with the mortgage markets.

I also believe that if you look at Bank of America's stock, it is back to its 2001 values. That means that all of the gains of the last seven years, the height of the mortgage and housing bubbles have been wiped out. I also think that's reasonable.

There are several ways you can play this stock in addition to buying it outright. If you are worried the stock is going to plummet, buy put options to protect your downside. A put option for January '09 at a strike price of $15 is $1.25. That means your dividend could pay for six months of insurance to ensure you don't lose money if the stock goes below 15. In a sense you'd be able to own the stock with controlled downside risk.

Perhaps even more intriguing, you could sell put options on Bank of America against the underlying stock you have purchased, generating additional income. This is called covered call writing. Right now, you could sell January '09 call options at a strike price of 20 for $3.80. That means that you'd buy the stock at 21 and be able to bring in $3.80 income (it's not total income because you might have to buy the call back at some later date if Bank of America stock doesn't fall below 20). But assuming you earned $2.00 in income from the call sale and another $1.28 from the dividend you'd have a return of almost 16%. For a good description of some of these options techniques click here.

It is in times of panic and market stress that the best money is to be made. When all of the pundits say sell, you should consider buying, and when they all say buy, you should consider selling. Remember, buy low and sell high.

Comments

Sam Cass

July 15, 2008

Bloomber is reporting that analysts think BofA will be cutting the dividend. If so, will the stock fall or is a dividend cut already prices into the stock?

"Goldman Sachs analysts recommended investors sell Zions and predicted dividend cuts may be in store for Zions, SunTrust Banks Inc., Comerica Inc. and Bank of America Corp. "

http://www.bloomberg.com/apps/news?pid=20601087&sid=aewKf7w2C5E0&refer=home

Is this review helpful? Yes:0 / No: 0

Add your Comment

or use your BestCashCow account