Even though we are coming down to the wire, it's increasingly likely that Congress will eventually pass some type of compromise bill that the President will sign. If they don't do it by August 2, then expect the markets to react negatively. There's nothing like a four to five hundred point drop in the stock market to get politicians moving. That's exactly what happened after Congress voted no on the first TARP vote during the height of the financial crisis.

So, let's assume the debt ceiling is eventually raised, as it will be. What does the future look like after? Unfortunately, it doesn't look like a very rosy scenario and if anything looks downright like another recession. That means lower rates on bank products for years to come, amongst other things: continued unemployment, stagnant stock market, weak dollar. Here are my reasons why:

1. Any budget deal will take trillions out of an already stagnant economy. Today, the The U.S. Bureau of Economic Analysis (BEA) announced that second quarter GDP increased at an annual rate of 1.3 percent in the second quarter of 2011. In the first quarter, real GDP increased an anemic 0.4 percent. The economy is already barely sputtering along. Now, what happens when trillions of dollars of cuts are made by the government? That's trillions of dollars taken out of the economy. Not good for stimulating growth.

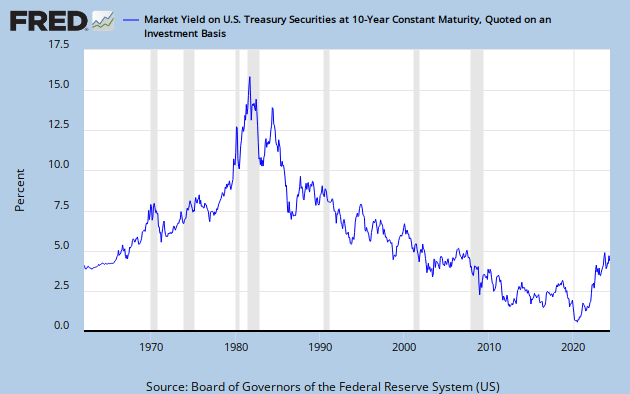

2. The benefits of lower debt will not materialize. The biggest stimulating influence of cutting debt is lower interest rates. But as the chart to ten year treasuries shows, interest rates are already at record lows. It's unrealistic to think rates will go any lower and even if they do, will probably not have much of an impact. Rate easing has reached a point of diminishing returns.

3. Slower growth will exacerbate the debt situation. The chart below shows the evolution of our debt problems. We have both a spending and revenue problem. The deficit has exploded because of both increases in spending and a drop in revenue due to the deep recession. 2009, 2010, and 2011 revenue is hardly back to 2001 levels even though the population of the country has grown and aged. A slowing economy will only depress tax revenue and increase expenditures for unemployment. This will require even more cuts or tax increases which will create a self-perpetuating cycle.

4. The population of the U.S. is aging. Demographics are working against us. An aging population means fewer productive workers, less income, and less consumption. The huge amount of cash and liquidity the markets have had for the last twenty years will begin to disappear as retirees cash in their savings to pay for living and medical expenses. This not just a U.S. phenomena. Japan, Europe, and China will also have demographic challenges. That means much of the developed world and some of the developing world will face tough demographic challenges, slowing worldwide growth.

It's hard to be optimistic about the short and medium term. The only good news is that eventually this cycle will end. The question is whether we have to wait another five years or another twenty before we overcome these challenges and the economic enters a faster phase of growth.

Comments

Depressed

August 02, 2011

We're headed for a major depression. Tea party doesn't understand economic principles. I find it very depressing.

Is this review helpful? Yes:0 / No: 0

Iggy

August 02, 2011

It's sad the situation we are in.

Is this review helpful? Yes:0 / No: 0

Russell

August 02, 2011

Stop your whining, get a job and become productive. If people would get back to work, we'd be fine. There are plenty of jobs out there but people don't want to work for lower wages. Get over yourself. Get back to work no matter what and things will start to get better. Some of the old jobs are done and aren't coming back. I guarantee you there are plenty of jobs that can support people if they are willing to work hard enough. No one promised an easy life. Just life, liberty and the pursuit of happiness.

Is this review helpful? Yes:0 / No: 0

Add your Comment

or use your BestCashCow account